Welcome to Harland Clarke, part of the Vericast family. We’re here to provide you with secure and easy personal and business check printing.

Let’s get started!

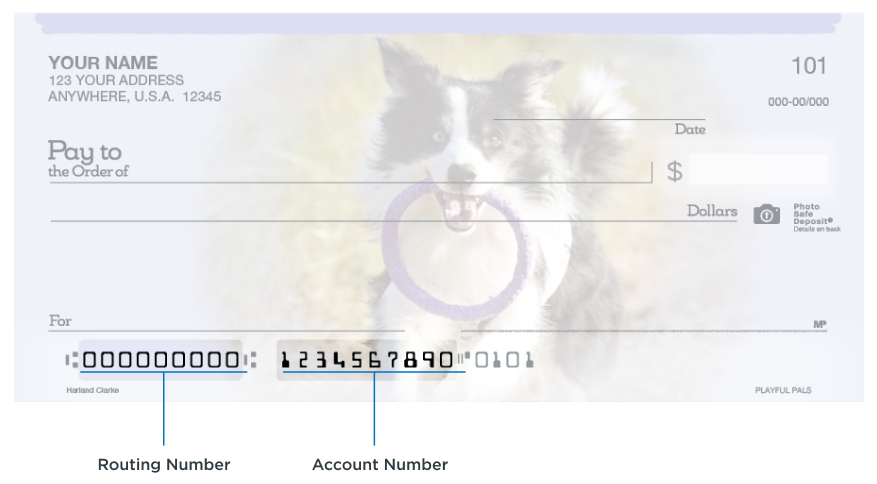

Please have your financial institution’s routing number and account number handy.

Click for help

Finding your Routing and Account Number

Concerned about check fraud?

Products & Services for Financial Institutions

If you are a banking professional looking for financial industry solutions, that content has moved to our parent company: Vericast®. Please visit vericast.com for bank and credit union solutions.