Acquire more low-cost core deposits, lucrative loans, and high-yield customers.

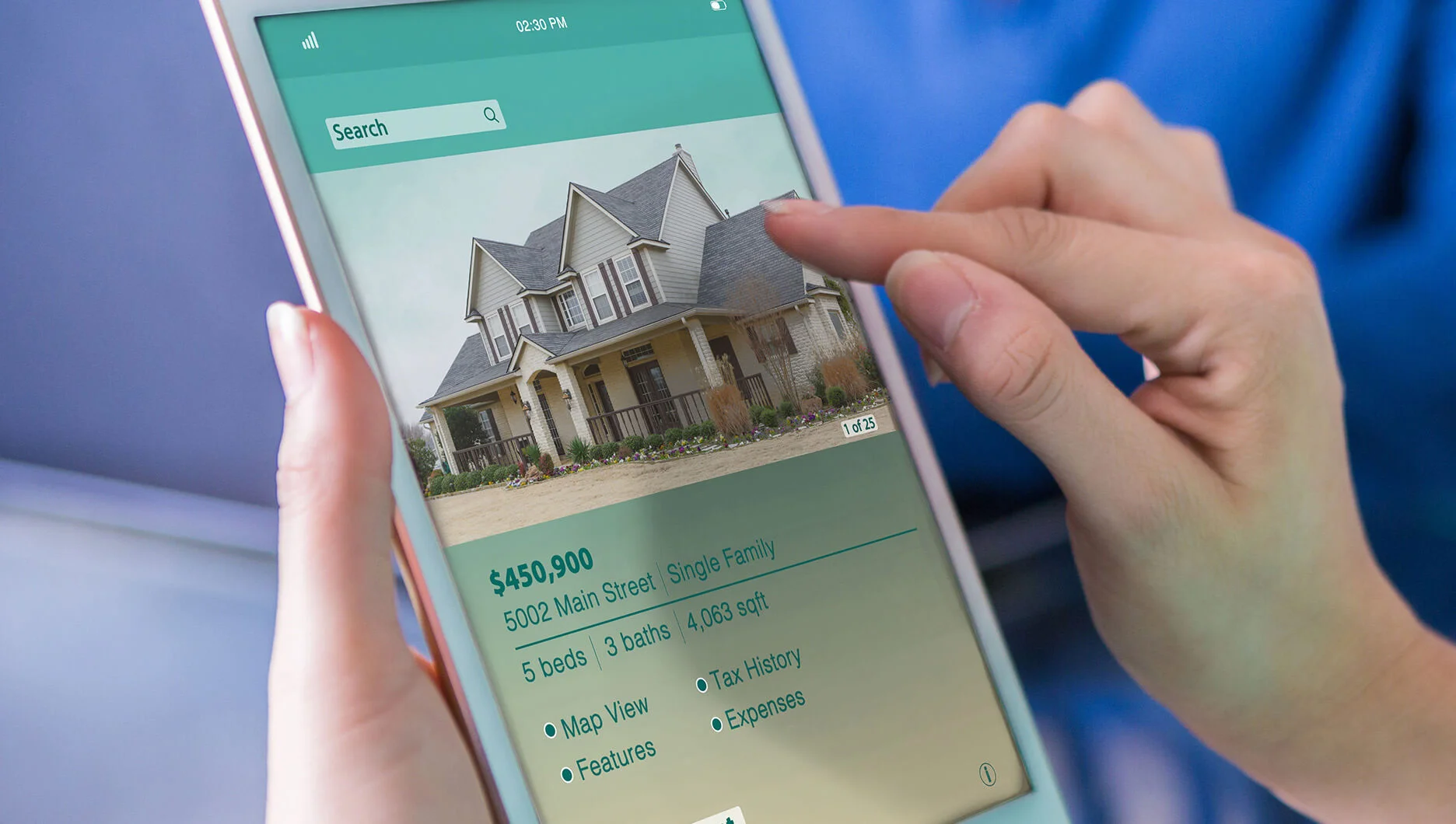

In today’s challenging financial services landscape, acquiring new customers is crucial for long-term growth. By combining your financial institution’s first-party data with our extensive third-party data and leveraging our expertise in marketing, finance, and media, we can craft tailored growth strategies for your institution, focusing on low-cost core deposits, lucrative loans, and high-yield customer acquisition, right down to the branch level.

Vericast enhances your financial institution’s long-term success by increasing account acquisitions, deepening customer relationships, and fortifying your balance sheet. We utilize proprietary data analytics and advanced modeling to identify prospects matching your ideal customer profile, engaging them through highly personalized, creatively compelling offers and proven messaging in the channels where they are most likely to respond.

Products

REPORT

Anatomy of a Banking Customer

An inside look at what bank customers want from you and where they want it.

The Vericast Advantage:

Customers receive relevant offers from you for the products they need, at the moment they need them.

Learn More About Acquisition & Retention

Don’t plan your next deposit and acquisition campaign without considering this important insight.

In this blog, Stephenie outlines the critical compliance factors that financial institutions should consider and their implications for acquisition marketing.

Matthew Tilley speaks with industry experts Lisa Nicholas, Chris Phelan, and Stephenie Williams to break down the challenges marketers in financial institutions face in uncertain economic conditions, and how to work through them.